Incorporating your one-person business (next steps)

How to have meetings with yourself and other stories

In my previous post, I talked about how it was easy to incorporate using the government of Canada website.

But after you incorporate, you have to do a bunch of other stuff outlined in this Government of Canada document. The document gives general guidelines, but for a company of one, you can simplify many things. That’s what this post is about.

Block quotes below are from the Government of Canada document linked above.

(Please see the obligatory disclaimer at the end of this post.)

Organizing your corporation

First directors

When you incorporated, you filed a form entitled Form 2 – Initial Registered Office Address and First Board of Directors. This form lists the first members of the board of directors of your corporation.

The mandate of the first directors begins on the date Corporations Canada issues the certificate of incorporation and ends at the first meeting of shareholders. At that first meeting of shareholders, the shareholders elect the corporation's directors. The shareholders can elect the first directors or elect other individuals.

Since I’m the only director, the "first directors" listed on Form 2 is just me. I don’t need to have elections at the first shareholder meeting, as I’m the sole shareholder and director. Nothing to do here.

Organizational meeting

Early in the life of your corporation, an incorporator or a director will likely call an "organizational meeting." The notice for this meeting must be sent at least five days before the meeting to each director listed in Form 2 – Initial Registered Office Address and First Board of Directors. This notice must indicate the date, time and place of the meeting.

Again, it’s just me, so I don’t need to send myself any notices for the meeting. Also, I’m not actually going to be holding a meeting with myself (I think there’s a funny joke to be made here, but I couldn’t come up with one).

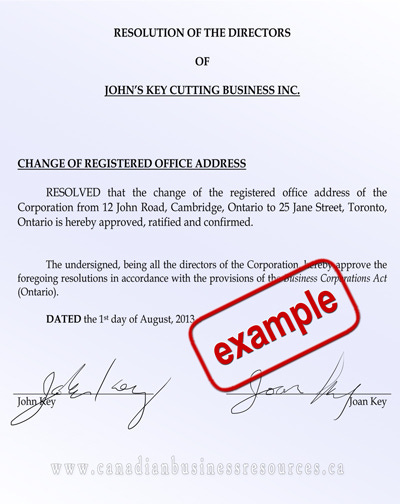

When you’re just one person, instead of meetings, you prepare and sign written resolutions. These are formal documents that record the same decisions typically made at organizational meetings.

How do you know what to write in your resolution? The structure is typically something like this:

Name of corporation;

Date;

Title of resolutions;

Preamble (brief description of context leading to the decision);

Resolutions;

Catch all resolution that authorizes representatives of the corporation to act on the resolutions; and

Signature block.

You can google it and find templates for different kinds of resolutions. If your resolutions are simple, which in my case they were, it’s not too tricky to use a combination of the instructions from the Government of Canada website, a bunch of templates as examples, and a bit of ChatGPT to help with some wording and formatting to prepare them. If you’re not comfortable doing that, probably you should go with one of the other two options for incorporation.

Once you’re done with the wording, slap it one some nice company letterhead, print it, sign it, and you’re done.

So what is supposed to happen at the organizational “meeting”?

At this meeting, the directors can:

make by-laws (see Making by-laws; these by-laws will have to be approved by shareholders at the first meeting)

adopt the forms of security certificates (shares) and corporate records the corporation will use

authorize the issuing of shares (see Issuing shares ) and other types of securities

appoint officers (see Appointing the officers)

appoint an interim auditor to hold office until the first meeting of shareholders

make banking arrangements

take care of any other business.

We’ll talk about by-laws, shares, and appointing officers below.

Do I need an auditor? No. Auditors are usually required for public corporations to protect investors. Most small single-owner corporations in Canada don’t need an auditor.

If you’re incorporated, you will need a business bank account. I just got one from my credit union and it wasn’t a big deal.

Making by-laws

By-laws are rules that govern the internal operations of a corporation. For example, you might want to set some rules for your corporation that are not dealt with in the Canada Business Corporations Act (CBCA). You also might want to modify some of the rules that are in the CBCA , as long as those changes are permitted by the Act. Some model by-laws can help you with content and wording.

Among other things, your by-laws can:

set the date of your corporation's financial year-end

make banking arrangements

address the appointments, qualifications and duties of officers

delegate the responsibility for setting the salaries of directors and officers

establish the salaries or other remuneration of directors and officers

set down the procedures for calling and conducting directors' and shareholders' meetings

establish the minimum number of people required at directors' and shareholders' meetings to establish quorum (that is, enough people to make binding decisions)

make rules limiting the modifications that can be made to the powers given to corporate directors under the CBCA (for ex., the by-laws could make all share issuances subject to shareholder approval).

Unless your corporation's by-laws state otherwise, the directors have the power to make, repeal and amend the by-laws. Every new by-law and any by-law change (including the repeal of a by-law) require shareholder approval at the first regular meeting of shareholders after the directors have passed the new or amended by-law. The effective date of a by-law is the date it is passed by the directors, not the date of approval by shareholders.

The model by-laws linked above are actually a template, which I used as a starting point. I modified some parts to make sense in the context of a single person, so things to do with voting or a quorum were tweaked/removed. Anything overly formal like giving 48 hours notice for meetings etc. was simplified. Everything else, to do with indemnity, liability, banking etc, I kept as is.

Issuing shares

One of your corporation's first activities following incorporation will be to issue shares. A person becomes a shareholder when a corporation "issues" shares in that person's name. Unless you indicate differently in your articles of incorporation or by-laws, your corporation's board of directors can generally issue shares whenever it wishes, to whomever it chooses, and for whatever value it decides.

Directors can decide to issue shares by majority vote. The directors' decision (called a resolution) to issue shares must be recorded in the corporation's minute books.

The corporation cannot issue a share until it actually receives full consideration (payment) for that share. This consideration is generally in the form of money, although it can also be in the form of services or property given to the corporation. A person's payment for the share(s), in a form agreed upon by the directors, represents that person's investment in the corporation.

Once a share has been issued, the shareholder is entitled to a share certificate. This certificate must state:

the corporation's name, as set out in the articles of incorporation

the name of the shareholder

the number and class of shares it represents.

If your articles of incorporation contain restrictions on share transfers (as do the articles of most small corporations), the share certificate itself must refer to these restrictions.

All shares are without nominal value (also known as par value). A share certificate does not carry any monetary value and no value appears on the certificate.

Since I’m the only owner, I just issue 100% of the corporation's shares to myself. For more complicated situations, there is probably a lot of nuance regarding how many shares to issue and how much they should cost, but for a simple situation like this, you can just issue 100 shares for $1 or $10 or whatever. It doesn’t really matter, but round numbers are nice.

Then you deposit the $100 (or $1000) into your company bank account and record it as share capital (equity) in Quickbooks.1

You need to draft a written resolution for the issuance of shares. You also need to make a share certificate. You prepare it, sign it, and give a copy to yourself and put another copy with your other corporate records. You also need to make a share register (this can be just a simple table with some information about who owns the shares). Templates for all of these things are out there.

Appointing Officers

Officers are responsible for the day-to-day operations of the corporation. The directors are responsible for appointing officers. With the directors, the officers will form the management of the corporation. Officers can take any position that the directors want them to fill (for ex., president, secretary or any other position).

Here I just appoint myself to all of the officer positions (e.g., president, secretary, treasurer). It’s just another written resolution.

First meeting of shareholders

The directors of your corporation must call the first shareholders' meeting within 18 months of the corporation's date of incorporation. This meeting is usually held after the first organizational meeting of the directors.

At this meeting, the shareholders:

elect directors

if the directors change from those you indicated on Form 2 – Initial Registered Office Address and First Board of Directors, you will need to file the change regarding directors (see Filing changes regarding directors)

confirm, modify or reject the by-laws established by directors

appoint an auditor. Note that this auditor can either be the same one appointed by the directors or a different one.

Again, I don’t need to have an actual meeting, I just need to prepare some written minutes to say that I approve the by-laws I drafted earlier and confirm myself as the director and waive the need for an auditor.

That’s it!

Summary

So, after incorporation, it’s really just a matter of writing and signing a bunch of documents. Mine were:

Written Resolution of the Sole Director - Organizational meeting

By-Law No. 1

Written Resolution of the Sole Director - Appointment of Officers

Written Resolution of the Sole Director - Issuance of Shares

Register of shares

Share certificate

Minutes of the First Meeting of Shareholders

These are all very straightforward, standard, templated documents that you can find examples of online. Piece of cake!

Disclaimer

The information shared in this post is based on my personal experience and is provided for informational purposes only. Incorporation processes and requirements may vary depending on your specific circumstances and jurisdiction. While I’ve done my best to share accurate and helpful insights, I encourage you to verify any steps or decisions with official resources or trusted sources to ensure they meet your needs.

If you need to put more money into the company for operating expenses or whatever, there are ways to do that which don’t have anything to do with shares. You can either create an equity account in your company and just add money into it, or you can make a shareholder loan to your company. There is info about this online.